In today’s digital age, fraudsters have found more sophisticated ways to exploit unsuspecting consumers. Fortunately, the same technology that enables these criminals to commit their crimes can also be used to combat them. By integrating mobile device technology with real-time monitors, businesses can stop fraudsters before they can commit any damage. Let’s take a closer look at this powerful combination of tools and how a guide to data observability can be beneficial.

How Mobile Devices Help In The Fight Against Fraudsters

Mobile devices are powerful tools that can help businesses detect and prevent fraud. Mobile devices’ primary benefit is allowing firms to capture real-time customer data. This means companies can use mobile devices to capture and process the data instantly instead of waiting for customers to enter their payment information on a website or in person.

Additionally, mobile devices allow businesses to collect customer location data which can be used to identify fraudulent activity from different geographic locations. Finally, by leveraging machine learning algorithms, mobile devices enable companies to analyze customer behavior patterns to identify suspicious activities or transactions quickly and accurately.

How Real-Time Monitors Help In The Fight Against Fraudsters

Real-time monitors are another critical component when it comes to combating fraudsters. These systems monitor online activity 24/7 and alert businesses when suspicious behavior is detected. This allows companies to take action quickly before any significant damage or money is lost due to fraudulent activity.

Additionally, real-time monitors provide detailed reports on suspicious transactions so companies can track potential threats and address them accordingly. This level of monitoring and analysis helps ensure that customers’ private data remains secure while giving businesses peace of mind knowing they are covered against potential threats from hackers or other malicious actors.

The Benefits Of Combining Mobile Devices & Real-Time Monitors To Combat Fraudsters

By combining mobile device technology with real-time monitors, businesses can create an effective defense against fraudsters without sacrificing convenience or customer experience. This comprehensive approach protects against fraudulent activities while allowing customers quick access to products and services without worrying about security risks associated with online transactions or sharing their personal information with unknown third parties.

Furthermore, this type of system eliminates many manual processes associated with fraud prevention, such as manual verification processes, which consume valuable time and resources and create additional risk if not done correctly.

Ultimately, this type of security solution gives businesses peace of mind knowing they have taken every precaution necessary to protect themselves from potential threats while providing customers the fast and convenient access they need when purchasing online or in person.

What Is Data Observability?

In today’s data-driven world, having complete and accurate insights into your organization’s data is more critical than ever. That’s where data observability comes in.

At its core, data observability is all about providing visibility and understanding of the health and performance of your data infrastructure. By implementing best practices around data quality, monitoring, and reporting, you can ensure your data is trustworthy and actively helping you make informed business decisions.

A guide to data observability can help companies monitor data quality, simplify data management, and improve decision-making.

How Can You Integrate Data Observability Into Your Organization?

To successfully integrate data observability into your organization, you must first understand the different data types and how they can be used. You should also consider the value that data observability provides to improve the accuracy and reliability of decision-making processes.

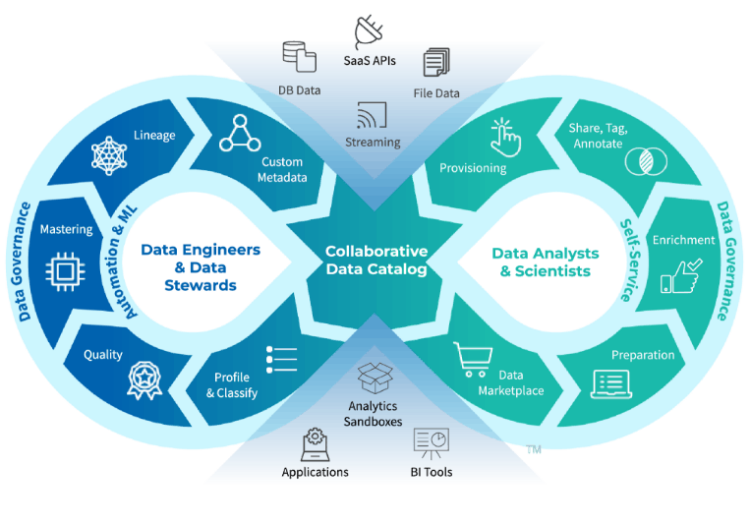

Once you understand what data observability is and why it matters, you can begin to create a data observability strategy. This involves identifying the key components of data observability, such as data collection and storage, analytics, reporting, and visualization; creating guidelines for using the data; and outlining processes for sharing, consuming, and maintaining the data.

Finally, you can then implement tools and technologies to ensure that your data is secure and up-to-date and to provide real-time alerts when suspicious activity is detected.

By combining data observability with mobile device technology and real-time monitors, businesses can create an effective defense against fraudsters by gaining greater visibility into their data infrastructure and taking action quickly before any potential harm or losses are incurred. This comprehensive approach ensures that customer data remains secure and protected while also allowing businesses to effectively mitigate any potential fraud threats.

Common Issues & Challenges Around Data Observability

Although data observability provides many benefits, there are some common issues that organizations face when trying to implement it. Issues such as data siloing, lack of data governance, and inadequate reporting can hinder the value of data observability. Additionally, security and privacy concerns must be addressed in order to ensure customer information is kept safe.

To address these issues, organizations should implement a data strategy that outlines how and when data is collected, stored, and shared. This will help to ensure that all stakeholders are on the same page when it comes to understanding data needs and expectations. Furthermore, processes should be implemented to ensure any security or privacy breaches are quickly addressed.

Data Observability And Real-Time Monitoring

Data observability and real-time monitoring go hand in hand. By combining both technologies, organizations can gain powerful insights into their data infrastructure to help them identify fraud faster and make more informed decisions.

Real-time monitoring helps companies quickly detect suspicious activity and respond to it swiftly before any losses are incurred. This is possible because the system constantly analyzes data in real-time and alerts users when something unexpected or suspicious occurs. Additionally, real-time monitoring provides a comprehensive view of an organization’s entire data infrastructure, allowing for greater visibility into the health and performance of the system.

Conclusion

Fraud prevention is critical for all business operations, especially online transactions where security risks are exceptionally high due to malicious actors looking to exploit vulnerable systems for financial gain or other purposes, such as stealing personal information or identity theft.

By combining mobile device technology with real-time monitors, businesses can ensure that their customers’ data remains safe while providing quick access to products and services without worrying about security risks associated with online transactions. Ultimately, this system offers optimal protection from potential threats while giving businesses and customers peace of mind knowing that their sensitive information always remains secure.